So, I recently got my hands on the OnePay – Mobile Banking app, and let me tell you, it’s quite the game-changer if you're looking to simplify your financial life. In today’s fast-paced world, having a reliable mobile banking app is essential, and OnePay really steps up to the plate. Here’s what I found after spending a good chunk of time exploring its features.

Getting Started with OnePay

Setting up OnePay was a breeze. I downloaded the app from the Play Store, and within minutes, I was up and running. The interface is sleek and intuitive, making it super user-friendly even if you’re not tech-savvy. Signing up required just a few basic details, and I appreciated how the app guided me through the process with clear instructions.

Once logged in, the dashboard showed me everything I needed at a glance. From checking my balance to viewing recent transactions, it’s all right there, and it’s as easy as pie. The app supports multiple banks, which is a huge plus if you juggle between different accounts.

Features That Stand Out

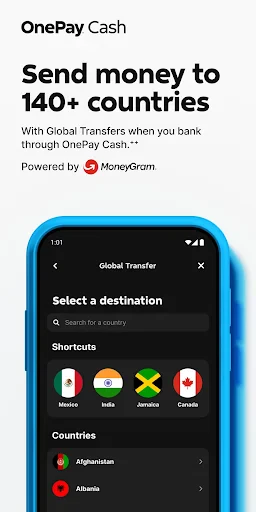

One of the standout features of OnePay is its ability to transfer money seamlessly. I tried sending some cash to a friend, and it was fast and straightforward. No more fumbling around with account numbers and codes; it’s all done with a few taps.

Another feature I found incredibly handy is the bill payment option. Whether it’s utilities, credit card bills, or even topping up your mobile phone, OnePay has got you covered. Plus, you can schedule payments, which means no more missed deadlines or late fees. How cool is that?

For those who like keeping an eye on their spending habits, the app provides detailed expenditure reports. It categorizes your spending so you can see exactly where your money is going. I found this particularly useful because it helps me stick to my budget without the hassle of manually tracking expenses.

Security and Support

Now, let’s talk about security because, let’s face it, with mobile banking, security is everything. OnePay uses top-notch encryption technology to ensure your data stays private and secure. I felt pretty confident knowing my financial information was in safe hands.

If you ever run into any issues, their customer support is just a tap away. I had a minor query and was impressed by how quickly they got back to me with a solution. It’s always reassuring to know help is available when you need it.

Final Thoughts

All in all, I’ve been genuinely impressed with OnePay – Mobile Banking. It’s practical, reliable, and makes managing your finances a whole lot easier. Whether you’re a newbie to mobile banking or a seasoned pro, this app has something to offer. It’s like having a bank in your pocket, minus the long queues and complicated processes.

If you’re looking to streamline your financial tasks, give OnePay a shot. You might just find it’s the banking solution you’ve been waiting for.